$TLT: Bonds Near Decade Lows, Fed Pivot Ahead

When Fed rates are high, Treasury yields are high. And when yields are high, bond prices are low.

Right now, $TLT (iShares 20+ Year Treasury Bond ETF) is trading near decade lows because the Fed has held rates at 20-year highs. The long-bond market (20+ years) moves inversely to yields — so if the 10-year yield drops, long-bond ETFs like TLT rally.

With the Fed expected to start cutting, this sets up one of the most asymmetric trades in the market.

-

Price: $89.2 — near decade lows

-

Dividend Yield: 4.45% (monthly)

-

Tax Advantage: Treasury income is exempt from state & city taxes

-

Macro Backdrop: CME FedWatch shows ~85–90% chance of a cut in Sept 2025, with rates possibly falling to 3.00–3.25% by June 2026

- FULL DSCLOSER I OWN ABOUT 250K IN TLT AND WILL ADD MORE

1. Owning $TLT Shares (The Steady Play)

📉 Why now?

TLT’s price is deeply discounted because 10-year yields are elevated. If the Fed cuts and yields compress, long-bond prices rise.

💸 The carry

Investors earn a 4.45% monthly yield, tax-advantaged at the state & city level.

📈 The upside

If long yields fall 100–150 bps, history suggests TLT can rebound 15–25% into the $105–110 range.

Bottom line: Shares = income + appreciation, no expiration risk.

2. Holding $TLT 2027 $100 Calls (The Convex Play)

📉 Setup

-

Strike: $100

-

Expiration: Jan 2027 (~2.5 years)

-

Price: ~$2.35

- FULL DISCLOSER I OWN 6 FIGURES OF LEAPS

📈 My estimates

-

If TLT rises +15%, calls could return 120–150%

-

If TLT rises +20%, returns could be 160–200%

-

If TLT rises +25%, returns could be 200–250%

This is because long-dated calls move ~8–10x the underlying once in-the-money.

⚠️ Risk: If inflation stays sticky or the Fed is slower to cut, time decay erodes premium.

Bottom line: Options = high-risk, high-reward leverage on falling yields.

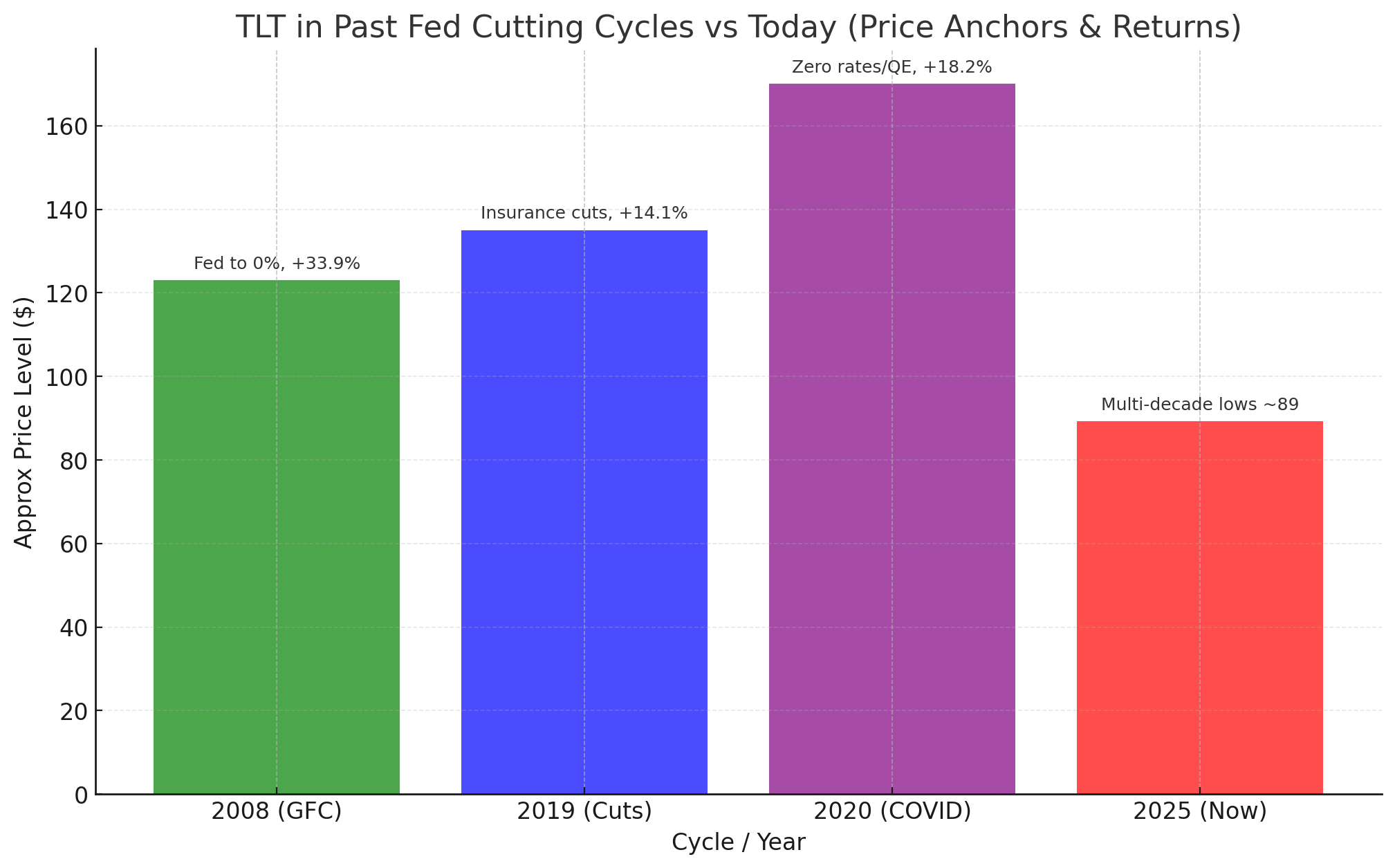

3. Historical Context

Every Fed cutting cycle this century has rewarded bond bulls:

-

2008 (GFC) → +33.9% total return (Fed slashed to zero)

-

2019 (Insurance Cuts) → +14.1% total return

-

2020 (COVID Pivot) → +18.2% total return

Today, TLT sits near $89.2 — close to decade lows — with the Fed set to pivot.

📊 Chart: TLT vs past cutting cycles

4. Risks to Watch

-

Inflation resurgence could keep long yields sticky

-

Treasury issuance is at record levels; foreign demand uncertain

-

Fed credibility — if cuts are shallow or inconsistent, bonds may underperform

Final Thought

-

Slow cuts → you’re paid 4.45% to wait

-

Aggressive cuts → LEAPS could 2–3x

-

If history rhymes → TLT rallies +15–34% as it has in prior easing cycles

Not advice. Just one framework: steady in one hand, convex optionality in the other.

Responses